In the fast-paced world of financial services, delivering personalized, efficient, and secure customer interactions is paramount. Salesforce Computer Telephony Integration (CTI) offers a powerful solution to streamline communication, enhance client experiences, and boost operational efficiency. By integrating telephony systems with Salesforce’s robust CRM platform, financial institutions can transform how they engage with clients, manage data, and drive business outcomes. This blog explores how Salesforce CTI empowers financial services firms, its key features, benefits, and implementation considerations, with a focus on providing informative insights.

Understanding Salesforce CTI and Its Relevance to Financial Services

Computer Telephony Integration (CTI) connects telephone systems with computer systems, enabling seamless communication through a unified interface. Salesforce CTI, specifically, integrates telephony features directly into the Salesforce CRM, allowing financial advisors, customer service representatives, and support teams to manage calls within the platform. This eliminates the need for separate phone systems and manual data entry, creating a centralized hub for client interactions.

In financial services, where trust, compliance, and personalization are critical, Salesforce CTI provides a competitive edge. Whether it’s a wealth management firm handling high-net-worth clients or a bank managing retail accounts, Salesforce CTI ensures agents have real-time access to client data, enabling informed and tailored conversations. Features like screen pops, call routing, and automated logging make it an essential tool for delivering exceptional service in a highly regulated industry.

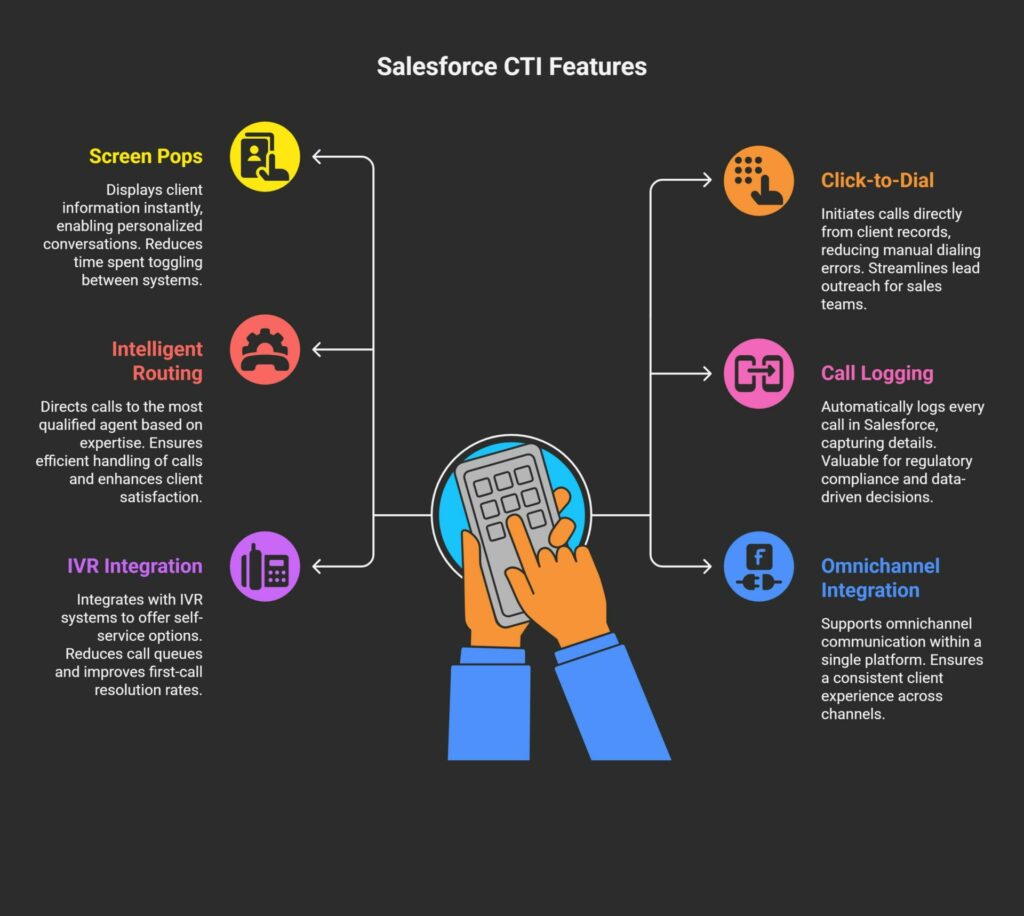

Key Features of Salesforce CTI for Financial Services

Salesforce CTI offers a suite of features designed to enhance communication workflows and improve client outcomes. Here’s a closer look at how these features benefit financial services organizations:

1. Screen Pops for Instant Client Insights

When a call comes in, Salesforce CTI automatically displays relevant client information, such as account details, transaction history, or open cases, on the agent’s screen. For financial advisors, this means instant access to a client’s portfolio, recent interactions, or pending inquiries, enabling personalized conversations without delays. This feature reduces the need to toggle between systems, saving time and minimizing errors.

2. Click-to-Dial and Automated Dialing

Salesforce CTI’s click-to-dial functionality allows agents to initiate calls directly from client records, reducing manual dialing errors. For outbound sales teams in financial services, automated dialing features, such as power dialing, streamline lead outreach, ensure advisors can focus on building relationships rather than administrative tasks.

3. Intelligent Call Routing

CTI telephony integration supports skill-based routing, directing calls to the most qualified agent based on expertise, language, or client segment. For example, a high-net-worth client can be routed to a senior wealth advisor, while a retail banking inquiry goes to a customer service specialist. This ensures efficient handling of calls and enhances client satisfaction.

4. Real-Time Call Logging and Reporting

Every call is automatically logged in Salesforce, capturing details like call duration, disposition, and notes. This is particularly valuable in financial services, where regulatory compliance requires detailed records of client interactions. Real-time reporting and analytics provide insights into agent performance, call volumes, and client satisfaction metrics, enabling data-driven decisions.

5. Interactive Voice Response (IVR) Integration

Salesforce CTI integrates with IVR systems to offer self-service options, such as balance inquiries or payment scheduling, reducing call queues and freeing agents to handle complex issues. For financial institutions, IVR can guide clients to the right department, improving first-call resolution rates.

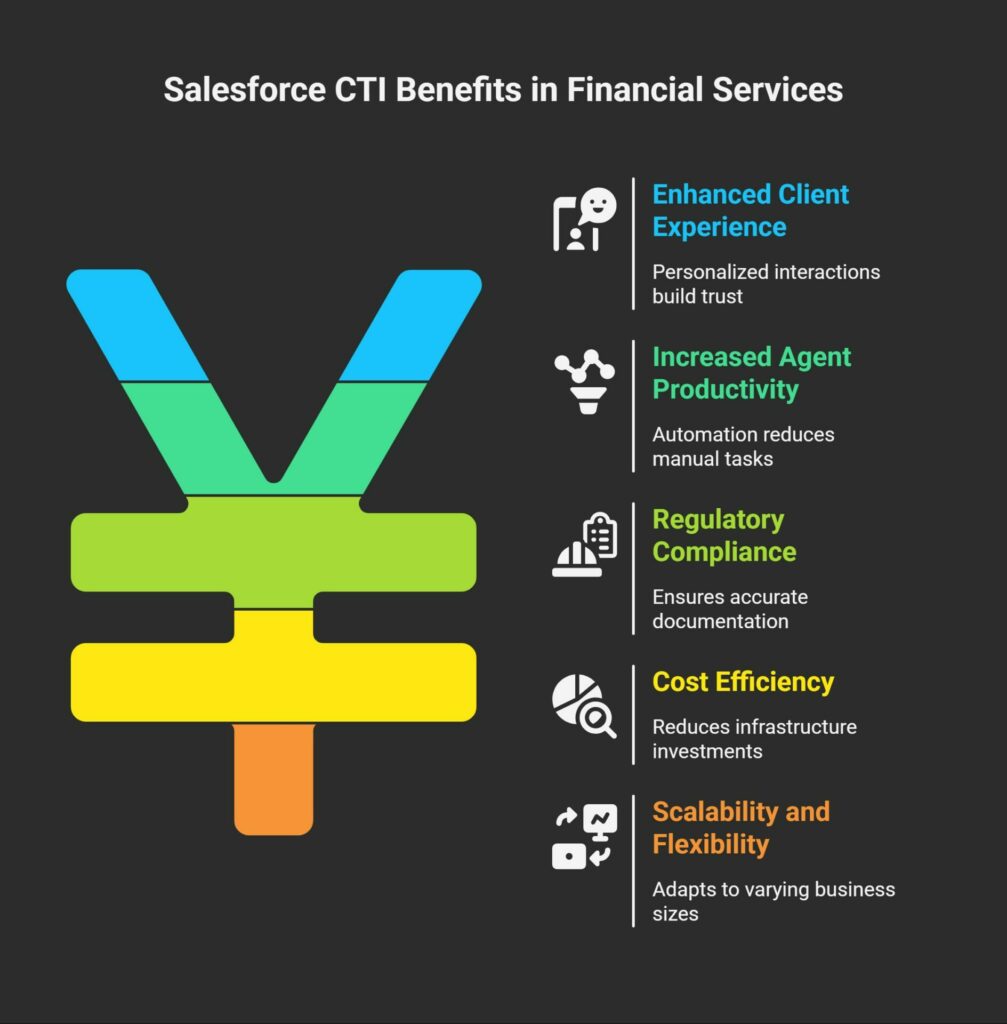

Benefits of Salesforce CTI for Financial Services

Implementing Salesforce CTI in financial services delivers measurable benefits that align with the industry’s unique needs. Here are some key advantages:

1. Enhanced Client Experience

By providing agents with immediate access to client data, Salesforce CTI enables personalized interactions that build trust. Clients feel valued when advisors understand their needs without repetitive questioning, leading to higher satisfaction and retention.

2. Increased Agent Productivity

Automation features like click-to-dial, automated call logging, and intelligent routing reduce manual tasks, allowing agents to handle more calls efficiently. This is especially important for financial services firms managing high call volumes during market fluctuations or tax seasons.

3. Regulatory Compliance

Financial services operate under strict regulations, such as GDPR, FINRA, or SEC requirements. Salesforce CTI’s automated call logging and reporting ensure accurate documentation of client interactions, simplifying compliance audits and reducing risk.

4. Cost Efficiency

Traditional telephony systems require significant infrastructure investments. Salesforce CTI, leveraging cloud-based VoIP technology, eliminates the need for physical phones at each workstation, reducing costs while maintaining scalability.

5. Scalability and Flexibility

Whether a small wealth management firm or a global bank, Salesforce CTI adapts to varying business sizes and needs. Integration with third-party systems via Salesforce Open CTI allows customization to match specific workflows, ensuring flexibility as businesses grow.

Implementation Considerations for Salesforce CTI

Integrating Salesforce CTI requires careful planning to maximize its benefits. Here are key steps and considerations for financial services firms:

1. Define Business Requirements

Identify specific needs, such as compliance tracking, call volume management, or integration with existing systems. This ensures the chosen CTI solution aligns with business goals.

2. Select a Compatible Telephony System

Choose a telephony provider that integrates seamlessly with Salesforce, such as Amazon Connect, Twilio, or Natterbox. Ensure compatibility with your existing infrastructure and compliance requirements.

3. Configure the Softphone Layout

Customize the softphone interface to display relevant client data, such as account balances or investment portfolios, and enable call controls like transfer or hold. Tailor the layout to match your brand’s preferences.

4. Leverage Open CTI for Customization

Salesforce Open CTI, a JavaScript API, allows integration with third-party telephony systems without desktop software. This is ideal for financial institutions seeking cloud-based, platform-agnostic solutions.

5. Train Agents and Test the System

Provide comprehensive training to ensure agents are comfortable with the softphone interface and features. Conduct thorough testing to verify call routing, data accuracy, and compliance features before full deployment.

6. Monitor and Optimize

Use Salesforce’s real-time analytics to track key performance indicators (KPIs) like average handle time (AHT) and first-call resolution (FCR). Continuously refine call flows and agent workflows to improve efficiency.

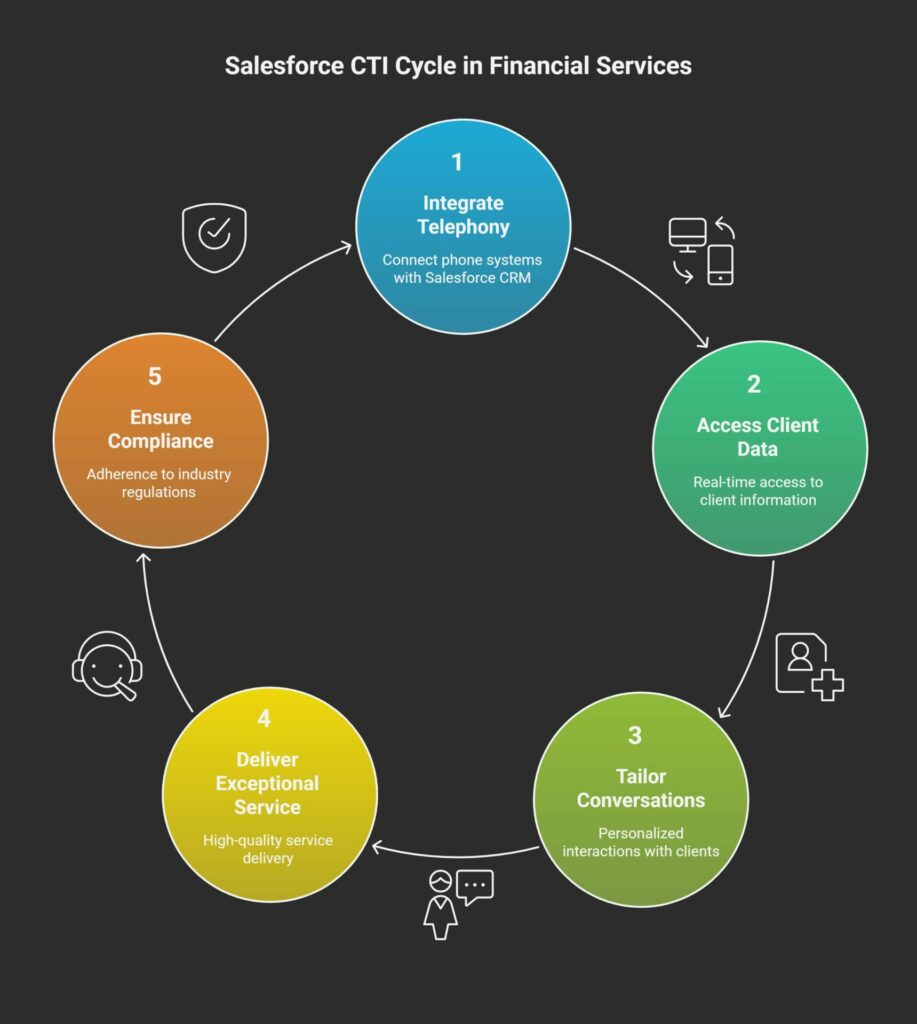

Why Financial Services Firms Should Embrace Salesforce CTI

The financial services industry thrives on trust, efficiency, and compliance. Salesforce CTI addresses these priorities by streamlining communication, automating repetitive tasks, and providing actionable insights. By integrating telephony with Salesforce’s CRM, firms can deliver exceptional client experiences, empower agents, and maintain regulatory compliance—all while reducing operational costs.

For example, a wealth management firm using Salesforce CTI can instantly access a client’s investment history during a call, recommend personalized financial products, and log the interaction for compliance. Similarly, a retail bank can use IVR to handle routine inquiries, freeing agents to resolve complex issues like loan applications or fraud disputes.

Discover CTI Ninja: Your Salesforce CTI Solution

Ready to elevate your financial services operations with Salesforce CTI? CTI Ninja, our cutting-edge Salesforce telephony integration, offers a seamless, AI-powered solution tailored to the needs of financial institutions. With features like advanced call routing, real-time analytics, CTI Ninja empowers your team to deliver exceptional client experiences.

Connect with us to learn more about CTI Ninja and schedule a free demo today. Transform your customer communication and stay ahead in the competitive financial services landscape!

![]()