Banks today operate in an environment where customers expect quick resolutions, secure communication, and highly personalized assistance. When trust is the currency, every single conversation matters. This is where Salesforce CTI integration becomes a critical enabler. By connecting telephony systems with Salesforce, banks gain a seamless, data-powered communication ecosystem that enhances transparency, reduces wait times, and elevates customer satisfaction. CTI Ninja, a Salesforce-native solution, helps financial institutions deliver consistent, professional, and compliant customer interactions.

The Need for Salesforce CTI in Modern Banking

Banks operate in an environment where customers expect speed, accuracy, and complete transparency. Traditional telephony systems often fall short, causing delays and frustration. Salesforce CTI integration eliminates these limitations by bringing every call directly into the CRM ecosystem. With real-time data, automated workflows, and contextual insights, banks can transform customer interactions into trust-building moments. Below are the key reasons why modern banks urgently need Salesforce computer telephony integration:

1. Rising Customer Expectations for Instant and Personalized Support

Customers no longer tolerate long queues or repeating information. They expect:

- Instant access to support without waiting in line.

- Personalized interaction, where agents already know their profile and past issues.

- Quick resolutions, regardless of whether the query is about accounts, credit cards, or loans.

Salesforce CTI integration ensures agents have full context before answering a call.

2. High Volume of Banking Queries and Operational Bottlenecks

Banks handle thousands of calls, daily complaints, queries, loan follow-ups, fraud alerts, and more. Without CTI for Salesforce:

- Calls get routed to the wrong department, increasing frustration.

- Agents juggle multiple tools, slowing down the resolution process.

- Repetitive data gathering wastes valuable time.

Salesforce telephony integration streamlines operations by reducing manual steps and enabling intelligent call routing.

3. Stringent Compliance and Secure Communication Requirements

Banking communication must meet strict RBI and internal compliance guidelines. Salesforce CTI helps banks ensure:

- Accurate call logs stored directly in Salesforce for audits.

- Secure and traceable communication, reducing compliance risk.

- Standardized processes that prevent human errors during customer interactions.

With every call captured and documented, banks maintain transparency and accountability.

4. Need for Real-Time Insights to Build Customer Trust

Trust depends on how confidently and accurately an agent can respond. Salesforce computer telephony integration provides:

- Instant screen pop with customer history, enabling contextual conversations.

- Actionable insights from CRM data during live calls.

- Faster decision-making improves customer confidence

This empowers agents to guide customers better and deliver a superior service experience.

5. Eliminating Inefficiencies of Legacy Telephony Systems

Traditional systems lack automation and visibility, leading to:

- Slower resolutions

- Unnecessary call transfers

- No unified view of customer interactions

Salesforce CTI gives banking teams a fully connected communication ecosystem that increases efficiency and consistency.

How Salesforce CTI Helps Banks Improve Customer Trust & Communication

Enhancing Transparency and Personalization: When customers call their bank, they want immediate recognition and quick solutions. Salesforce telephony integration allows agents to view customer information the moment the call arrives. With CTI Ninja’s instant screen pop, agents can greet customers by name, and offer proactive assistance. This level of personalization builds trust and reassures customers that their bank truly knows them and values their relationship.

Reducing Waiting Time and Improving First-Call Resolution: Nothing hurts customer trust more than long call queues or repeated transfers. Through Salesforce CTI, banks can intelligently route calls to the right department based on customer type, inquiry nature, or priority level. With features like click-to-call, omnichannel access, and call logging, CTI Ninja enables banking teams to resolve queries faster. Reduced waiting time and increased first-call resolution directly contribute to higher customer satisfaction and credibility.

Ensuring Communication Security and Compliance: Banks must maintain strict communication compliance, from call recording to data handling. Salesforce CTI integration provides a secure environment where every interaction is logged directly into Salesforce, reducing manual errors and ensuring complete audit trails. CTI Ninja supports secure call handling workflows and ensures communication processes adhere to banking regulations, thereby improving operational trustworthiness.

Strengthening Agent Productivity with Real-Time Insights: Agents in banks often face pressure to respond quickly while handling complex queries related to loans, credit cards, KYC updates, or disputed transactions. Salesforce CTI integration equips them with real-time data, past interaction history, and recommended next actions right within the call interface. With CTI Ninja, agents no longer switch between multiple systems, reducing cognitive load and increasing accuracy. When customers experience confident, well-informed responses, their trust in the bank grows significantly.

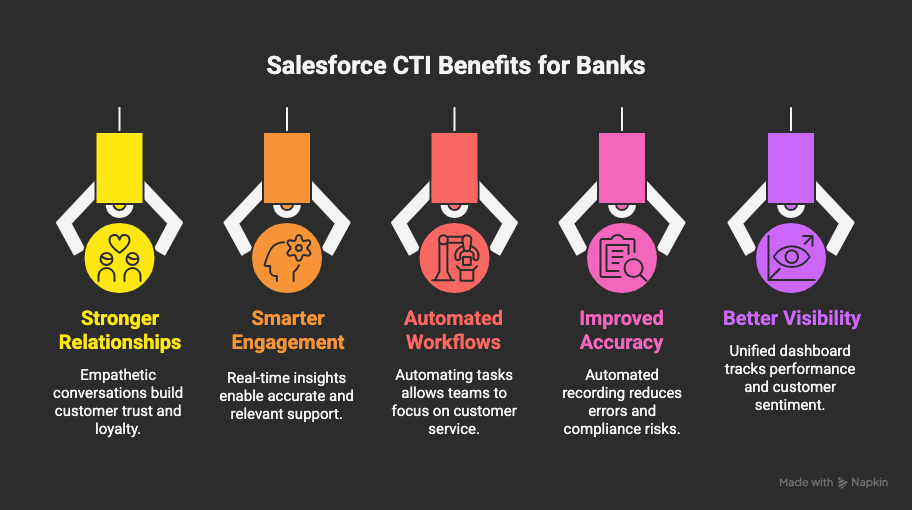

Key Benefits of Salesforce Computer Telephony Integration for Banks

Stronger Customer Relationships: Salesforce CTI equips agents to deliver conversations that are informed, empathetic, and personalized. When customers feel understood and valued, their trust in the bank strengthens, leading to long-term loyalty and deeper financial relationships.

Smarter Customer Engagement: With real-time insights and contextual data from Salesforce, agents can guide customers confidently whether the query relates to loans, credit cards, wealth management, or account services. This data-driven engagement helps banks provide accurate, timely, and relevant support.

Operational Efficiency with Automated Workflows: CTI for Salesforce automates key activities such as call logging, task creation, and post-call follow-ups. By eliminating repetitive manual work, banking teams can focus on delivering exceptional customer service and strengthening client communication.

Improved Accuracy and Reduced Human Error: Manual processes often lead to mistakes, especially during fast-paced banking interactions. Salesforce computer telephony integration ensures every call, note, and action is automatically recorded in the CRM. This enhances accuracy, reduces compliance risks, and ensures smoother customer interactions.

Better Visibility for Supervisors and Management: Bank leaders need complete visibility into daily communication patterns to make informed decisions. With Salesforce telephony integration, supervisors can track agent performance, call volume trends, customer sentiment, and resolution speed all from a unified dashboard. This empowers banks to improve service quality and optimize workforce planning.

Why Banks Choose CTI Ninja for Salesforce CTI Integration

CTI Ninja is designed for high-volume banking operations where precision and speed matter. As a Salesforce-native computer telephony integration solution, it supports lightning-fast call handling, automated workflows, and advanced caller intelligence. Banks using CTI Ninja experience improved customer communication, reduced operational friction, and enhanced agent productivity. With robust support for compliance, secure call management, and CRM-driven insights, CTI Ninja becomes an essential tool for institutions relying on customer trust.

Conclusion

In a trust-driven industry like banking, every customer interaction shapes perception. Salesforce CTI integration empowers banks to deliver faster, more transparent, and personalized communication experiences that strengthen loyalty. CTI Ninja makes this transformation seamless by combining advanced telephony features with Salesforce intelligence. For banks looking to enhance customer confidence, streamline communication, and elevate service quality, adopting a Salesforce CTI solution is no longer optional; it’s a strategic advantage.

![]()