In the banking and financial services industry, trust is not built overnight; it is earned through every interaction a customer has with an institution. Whether it is a routine balance inquiry, a loan discussion, or a sensitive fraud-related call, customers expect absolute security, accuracy, and professionalism. A single misstep in communication can lead to dissatisfaction, complaints, or even customer churn, making trust the most valuable currency in BFSI relationships.

Modern customers also have rising expectations. They want communication to be fast, seamless, and personalized, without repeatedly sharing the same information across multiple touchpoints. However, when call systems operate separately from CRM platforms, agents lack visibility into customer history, resulting in fragmented conversations and repeated verification steps. These disconnected experiences often erode customer confidence.

Salesforce CTI addresses this gap by integrating telephony directly into the CRM. When combined with a purpose-built solution like CTI Ninja, Salesforce CTI becomes a powerful trust-enabling tool, allowing BFSI institutions to deliver secure, intelligent, and context-aware customer communication.

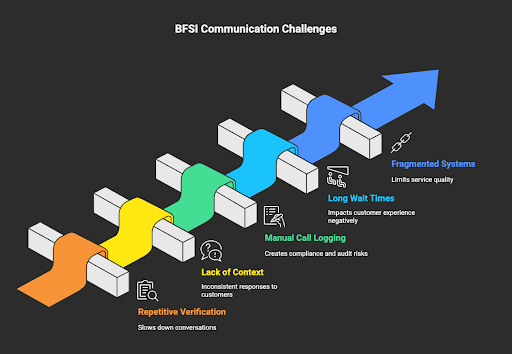

The Communication Challenges Faced by BFSI Institutions

Repetitive Customer Verification Slowing Down Conversations

BFSI organizations manage a massive volume of customer calls every day, many of which involve sensitive financial information or urgent service requests. One of the most common pain points in these interactions is repetitive customer verification. When agents do not have immediate access to caller profiles, customers are repeatedly asked to confirm their identity, account details, or previous requests. This not only increases call handling time but also frustrates customers who expect banks and financial institutions to already recognize them.

Lack of Caller Context Leading to Inconsistent Responses

Another critical challenge is the absence of complete caller context during live interactions. When agents answer calls without visibility into a customer’s past conversations, transaction history, or ongoing service cases, the responses can feel disconnected or incomplete. Customers may receive different answers from different agents, which creates confusion and weakens confidence in the institution’s reliability and professionalism.

Also Read – Salesforce CTI Solution: Why Your Sales Team Needs This

Manual Call Logging Creating Compliance and Audit Risks

Manual call logging continues to be a major operational hurdle for BFSI institutions. When agents are required to enter call details manually after conversations, the chances of missing information or recording errors increase significantly. In a highly regulated industry, such gaps can lead to compliance risks, audit challenges, and potential regulatory penalties, making manual processes both inefficient and risky.

Long Wait Times and Multiple Call Transfers Impacting Customer Experience

Customers often experience long wait times and multiple call transfers due to inefficient call routing and lack of real-time information. Being transferred repeatedly between departments signals operational inefficiency and makes customers feel undervalued, especially when dealing with urgent financial concerns.

Fragmented Telephony and CRM Systems Limiting Service Quality

These challenges are further intensified when telephony systems and CRM platforms operate in silos. Without a unified system, agents lack a holistic view of the customer journey, making it difficult to deliver fast, personalized, and consistent service. As customer expectations continue to rise, BFSI institutions without integrated communication platforms struggle to meet modern service standards.

What Is Salesforce CTI and Why It Matters for BFSI

Salesforce CTI, or Computer Telephony Integration, enables financial institutions to manage calls directly within Salesforce CRM. Instead of switching between multiple systems, agents can receive, make, and manage calls from a single interface while accessing real-time customer data.

For BFSI organizations, this integration is particularly critical. It ensures that customer records, call history, and service requests are instantly available during conversations. CTI Ninja enhances this capability by providing a seamless Salesforce-native CTI experience that simplifies call handling, improves visibility, and strengthens service accuracy.

With real-time access to customer data, agents can respond with confidence, reduce errors, and ensure every interaction aligns with regulatory and security requirements.

Also Read – CTI Ninja Goes Live on Salesforce AppExchange: Redefining Customer Conversations with AI-Powered Telephony

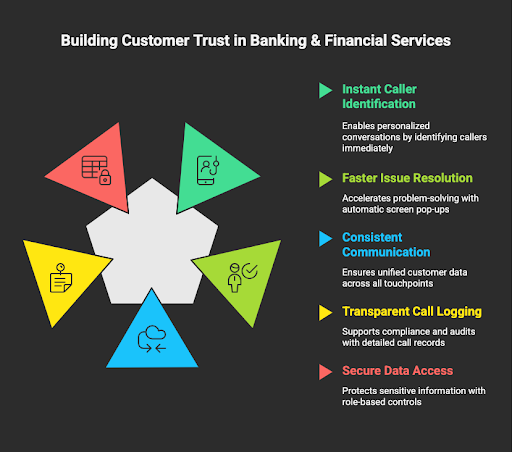

How Salesforce CTI Builds Customer Trust in Banking & Financial Services

Instant Caller Identification for Personalized Conversations

Salesforce CTI strengthens customer trust by enabling instant caller identification the moment a call is received. By automatically fetching relevant Salesforce records, agents gain immediate visibility into customer account details, previous interactions, and ongoing service requests. This eliminates the need for customers to repeat information and creates a more personalized conversation. When customers feel recognized and understood from the start, their confidence in the institution naturally increases.

Faster Issue Resolution Through Intelligent Screen Pop-ups

Automatic screen pop-ups play a crucial role in accelerating issue resolution. As soon as a call connects, the correct customer record appears on the agent’s screen, allowing them to focus entirely on solving the problem instead of searching for data. Reduced call handling time leads to quicker resolutions, reinforcing the customer’s perception that the institution is efficient, capable, and responsive to their needs.

Also Read – 5 Signs Your Business Needs CTI Integration with Salesforce

Consistent and Reliable Communication Across All Touchpoints

Salesforce CTI ensures consistency by providing all agents access to a centralized and unified customer data source. Whether a customer contacts a branch office, support desk, or relationship manager, the information remains accurate and up to date. This consistency prevents conflicting responses and builds a strong sense of reliability and professionalism—key factors in earning and maintaining customer trust in BFSI.

Transparent Call Logging for Compliance and Audit Readiness

From a regulatory standpoint, Salesforce CTI automatically logs every call with detailed timestamps and interaction records. This creates a transparent and traceable communication history that supports audits and compliance checks. Customers gain assurance knowing that their conversations are properly documented and handled in line with regulatory standards, further strengthening trust in the institution.

Secure Data Access for Sensitive Financial Information

Security is a non-negotiable requirement in banking and financial services, and Salesforce CTI reinforces this through robust, role-based access controls. Sensitive customer and financial data is visible only to authorized users, ensuring that information is handled securely during every interaction. This controlled access environment protects customer privacy and reinforces trust at every stage of the communication process.

Also Read – Optimizing Logistics Operations with Ksolves’ Salesforce CTI Ninja

Role of CTI Ninja in Strengthening BFSI Customer Experience

CTI Ninja is designed to make Salesforce CTI adoption seamless and impactful for BFSI organizations. It integrates smoothly with Salesforce without requiring complex custom development, enabling institutions to go live faster and with minimal operational disruption.

By providing real-time call activity tracking within Salesforce, CTI Ninja helps supervisors monitor performance and ensures agents stay productive. The solution reduces operational friction, allowing agents to focus on meaningful customer conversations instead of administrative tasks.

CTI Ninja is also built to scale, making it suitable for banks, NBFCs, fintech companies, and insurance providers that manage growing call volumes while maintaining high service standards.

Also Read – Top 5 Benefits of Integrating CTI Ninja into Your CRM Workflow

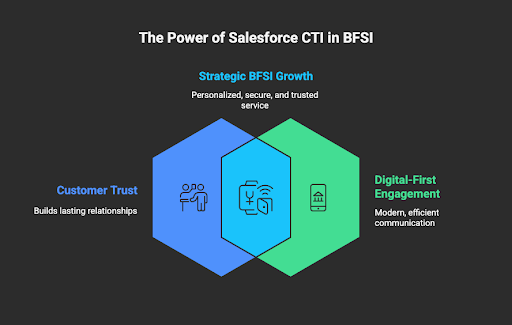

Why Salesforce CTI Is a Strategic Investment for BFSI

In an industry where products and interest rates are often similar, trust becomes the true differentiator. Salesforce CTI supports this by enabling faster, more secure, and more personalized communication. As BFSI institutions move toward digital-first engagement models, CTI becomes a long-term strategic investment that supports customer-centric operations and sustainable growth.

Conclusion: Turning Every Call into a Trust-Building Moment

Salesforce CTI empowers BFSI organizations to transform routine customer calls into trust-building experiences. By enabling instant caller identification, faster issue resolution, consistent communication, and secure data handling, it addresses the core challenges of BFSI customer engagement.

With CTI Ninja, organizations can fully leverage Salesforce CTI to deliver reliable, compliant, and intelligent customer communication at scale. For banks and financial institutions looking to strengthen customer trust while improving operational efficiency, CTI Ninja provides a dependable and future-ready CTI solution.